Imagine trying to sell to every business out there. It’s like trying to have a meaningful conversation in a packed stadium by shouting from the fifty-yard line. You’ll be loud, but you won’t connect with anyone. B2B market segmentation is the process of breaking that massive stadium down into smaller, more intimate private boxes.

Instead of a generic, one-size-fits-all pitch, you group potential business customers by shared traits—things like their industry, company size, or how they make buying decisions. This lets you craft targeted sales and marketing strategies that actually speak to their specific needs, which is the secret to better conversion rates and building real customer relationships.

What Are B2B Market Segments and Why They Matter

Let's stick with that stadium analogy for a moment. Instead of yelling a single message from the stage, market segmentation is like giving your team a set of VIP passes. You can walk right into those private boxes and have direct, relevant conversations with the exact groups who are most interested in what you have to offer.

At its core, segmentation is about dividing a broad market into smaller, more manageable subgroups. These groups, or B2B market segments, are defined by real-world factors that dictate how a company thinks, operates, and buys. Once you understand these nuances, you stop wasting time, energy, and money on businesses that were never going to be the right fit anyway.

The Strategic Value of Segmentation

Segmentation isn’t just a neat marketing exercise; it’s a cornerstone strategy for real, sustainable growth. It brings a powerful clarity to your entire operation, allowing you to focus your resources where they’ll deliver the biggest punch. Without it, your sales and marketing teams are essentially flying blind.

The payoff is huge and shows up in a few key ways:

- Smarter Resource Allocation: You can funnel your budget and your team’s valuable time toward the prospects most likely to say "yes."

- Deeper Personalization: Your messaging, product demos, and sales pitches can be fine-tuned to solve the specific headaches of each segment.

- Higher Quality Leads: You start attracting prospects who are a natural fit for your solution, which means shorter sales cycles and better close rates.

- Lasting Customer Relationships: When customers feel like you truly "get" them, they don't just buy from you—they become loyal fans.

By focusing on specific B2B market segments, you transform your go-to-market strategy from a shotgun blast into a series of precision strikes. This focus is critical for cutting through the noise and achieving measurable business outcomes.

This approach is more crucial than ever as B2B buying moves online. The global B2B eCommerce market was valued at $13.29 trillion in 2019 and is projected to skyrocket to $32.11 trillion by 2025. That explosive growth proves that businesses now demand relevant, seamless digital experiences—something you can only deliver through smart segmentation.

Ultimately, defining your market segments is the critical first step. It's the foundation for everything that follows, giving you the clarity you need before you can effectively figure out how to identify target customers.

The Core Methods of B2B Market Segmentation

To really get a handle on your B2B market, you need a solid toolkit of segmentation methods. Think of these not as strict rules, but as different lenses. Each one gives you a unique, valuable perspective on your potential customers. When you combine them, you go from a blurry, wide-angle shot of your market to a series of sharp, focused portraits of your ideal buyers.

These methods help you answer the big questions. Who are they? Where are they? How do they operate? And, most importantly, what do they actually need from a solution like yours? Let's break down the four essential models that get you those answers.

Firmographic Segmentation: The Company Resume

Firmographics are your starting point, the foundational layer of segmentation. This is all about the basic, observable facts of a business. Think of it like glancing at a company’s LinkedIn profile—it gives you the “who” and “what” right away. It’s the easiest way to start grouping similar businesses together.

This model is built on objective data that’s usually pretty easy to find. These details provide a high-level snapshot of a company's size, industry, and overall structure.

Common firmographic variables include:

- Industry: Is the company in manufacturing, healthcare, finance, or tech? A software solution built for a hospital has totally different requirements than one for a bank.

- Company Size: This is usually measured by employee count or annual revenue. A 10-person startup operates on a completely different scale and budget than a 10,000-employee enterprise.

- Annual Revenue: This is a great indicator of a company's financial stability and potential budget, helping you focus on businesses that can actually afford what you're selling.

- Geographic Location: While this crosses over with geographic segmentation, at this level, it's just about noting where the company's main offices are.

Using firmographics, you can create broad but crucial segments. For example, a SaaS company might use this to target mid-sized tech firms (50-250 employees) in the Nordics with an annual revenue over €10 million.

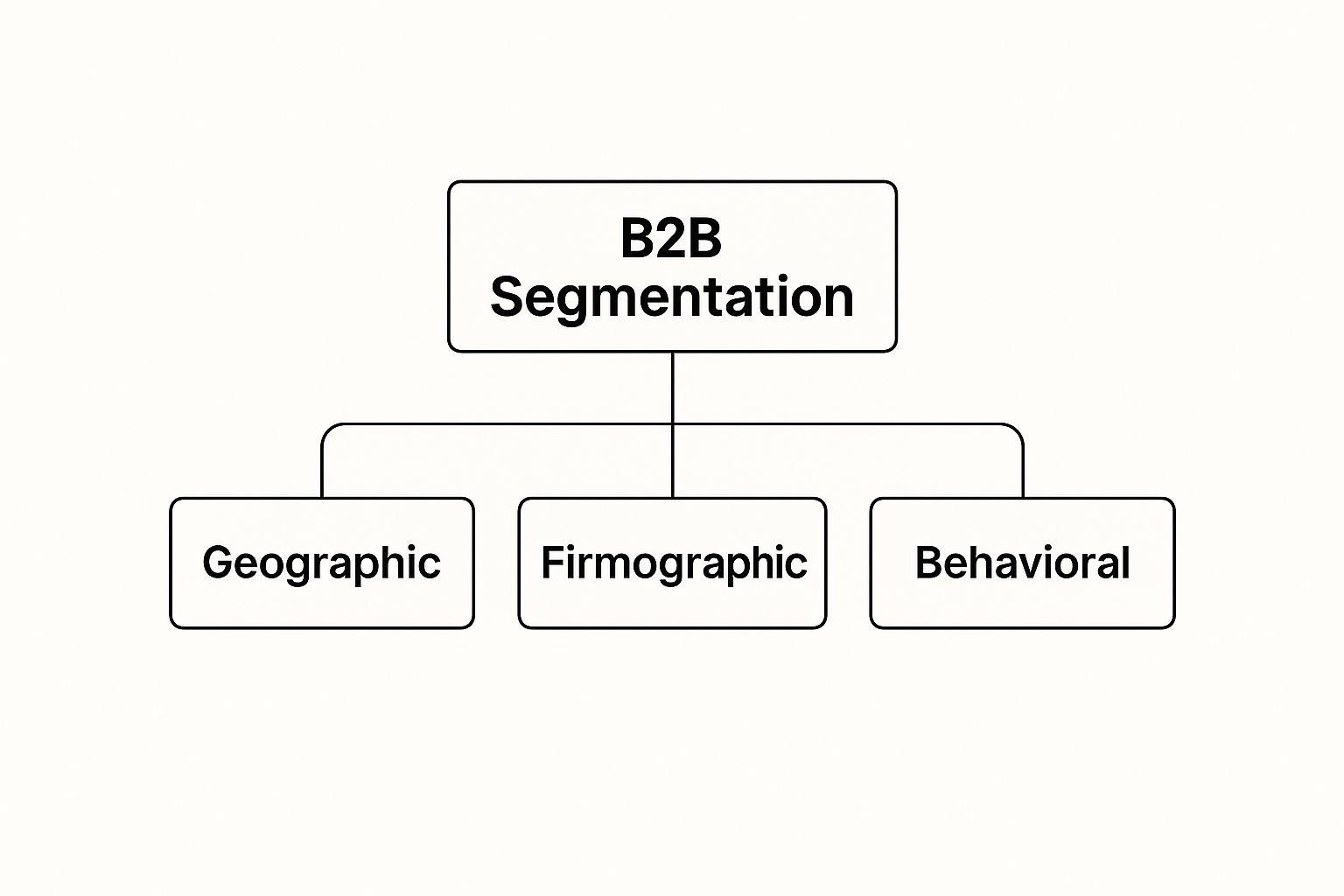

The image below shows how firmographics work alongside other methods to create a full picture.

As you can see, firmographics, geography, and behavior are distinct pillars that, when combined, build a much stronger segmentation strategy.

Geographic Segmentation: The Local Context

Firmographics might tell you a company is based in Sweden, but geographic segmentation digs much deeper. It’s about understanding the context of where a business operates. A company in Stockholm faces a different cultural, economic, and regulatory environment than one in Helsinki or Oslo, and that matters.

This approach is non-negotiable for any business with a physical product or one whose services are influenced by local factors. It's about more than just a pin on a map.

A company's location shapes its priorities, challenges, and opportunities. Ignoring the geographic context means missing out on crucial nuances that drive purchasing decisions.

For instance, a logistics software provider would naturally target businesses clustered around major shipping ports. Likewise, a company selling renewable energy solutions would focus its efforts on regions with strong government incentives for sustainability. It’s all about tailoring your message to fit the local reality.

Behavioral Segmentation: The Action Story

If firmographics are the resume, then behavioral segmentation is the story of how a company actually operates day-to-day. This is a powerful method that groups businesses based on their actions, interactions, and habits. You're moving beyond static data to get a dynamic look at their purchasing patterns and tech usage.

Behavioral data can cover a lot of ground:

- Purchase History: Are they making frequent, small purchases or just one big one every few years? Are they a brand-new customer or a loyal partner?

- Product/Service Usage: How are they using your product? Are they power users digging into every advanced feature, or do they just stick to the basics? This is gold for spotting upsell opportunities.

- Technology Stack: What other software are they using? A company running on Salesforce might be a perfect fit for your new CRM integration, while one using a competitor’s tool is a prime target for a migration campaign.

- Website Engagement: Which pages did they visit on your site? Did they download a whitepaper on a specific topic? These are clear signals of their current pain points.

By analyzing these behaviors, you can create incredibly relevant segments, like "loyal customers due for an upgrade" or "prospects interested in Feature X who haven't converted yet."

Needs-Based Segmentation: The Why Behind the Buy

This brings us to what is arguably the most insightful segmentation method. Needs-based segmentation groups customers based on the specific problems they’re trying to solve or the goals they want to achieve. It gets right to the heart of the matter: "Why would this business buy from me in the first place?"

This approach looks past what a company is (firmographics) or what it does (behavioral) to understand its core motivations. For example, you could have two companies in the same industry and of the same size, but with completely different needs. One might be obsessed with reducing operational costs, while the other is laser-focused on improving employee productivity.

The global B2B market is a perfect example of this diversity. Small and medium-sized businesses (SMEs) often hunt for flexible, cost-effective tech, while large enterprises invest in complex, integrated systems. As the market shifts, you can see specific needs-based segments like merchant marketing software and on-demand delivery services are set to expand significantly. You can dive deeper into these B2B market dynamics and projected growth to see this in action.

When you understand these underlying needs, you can tailor your value proposition to hit home, crafting a message that speaks directly to a customer's primary objective.

Comparing B2B Segmentation Models

Each of these four models gives you a different piece of the puzzle. Looking at them side-by-side makes it clear how they work together to build a complete customer profile.

| Segmentation Type | What It Measures | Example Data Points | Best For Answering |

|---|---|---|---|

| Firmographic | Who the company is | Industry, company size, annual revenue, location | "What types of companies should we target?" |

| Geographic | Where the company operates | Country, region, city, climate, local regulations | "Where should we focus our sales and marketing efforts?" |

| Behavioral | How the company acts | Purchase history, product usage, tech stack, website activity | "How do our best customers interact with us?" |

| Needs-Based | Why the company buys | Pain points, desired outcomes, strategic goals, budget priorities | "What specific problem does our solution solve for them?" |

Ultimately, the most effective B2B segmentation strategies don't just pick one model; they layer them. You might start with broad firmographics, narrow down by geography, and then fine-tune your messaging based on specific behaviors and needs. This multi-layered approach is what separates generic marketing from a truly targeted and successful sales strategy.

Bringing B2B Market Segments to Life

Theory is one thing, but seeing B2B market segments in action is where the lightbulb really goes on. It’s when abstract models stop being just diagrams on a whiteboard and become practical tools that actually guide decisions and get results.

Let's walk through a story. Imagine a fictional SaaS company called "ChainFlow" that sells supply chain logistics software. Their journey is a perfect example of how layering different segmentation models creates a focused, high-impact go-to-market strategy.

Stage 1: The Firmographic Foundation

When ChainFlow started, they were doing what a lot of new companies do: casting a wide net. They tried selling their software to any business even remotely involved in logistics. As you can guess, their marketing was generic, and the sales team was spinning their wheels. Their message wasn't resonating because they weren't talking to anyone in particular—they were just shouting into the void.

The leadership team knew something had to change. The first move? Applying a simple firmographic filter. They looked closely at their handful of happy customers and spotted a clear pattern. The smoothest, most successful projects were all with mid-sized manufacturing firms (100-500 employees) based in North America.

This basic firmographic slice immediately sharpened their focus. Instead of targeting everyone, they suddenly had a well-defined group to go after.

Stage 2: Layering on Behavioral Insights

This was a huge step up, but ChainFlow quickly learned that not all mid-sized manufacturers are created equal. They started noticing key differences in how these companies approached technology, which led them to the next layer: behavioral segmentation.

By digging into their website analytics, demo requests, and sales call notes, they uncovered two very different behavioral profiles:

-

Legacy System Upgraders: These folks were stuck on old, clunky, often on-premise software. Their biggest pain point was inefficiency and the headache of systems that didn't talk to each other. They were cautious, methodical buyers who needed to see a solid ROI and a crystal-clear migration plan.

-

Digitally Native Adopters: This group was made up of newer companies or those who had already embraced the cloud. They weren't worried about replacing ancient systems; they were hungry for advanced features like AI-powered forecasting and IoT integration. They wanted the future, now.

This behavioral split was a game-changer. ChainFlow could finally stop giving one-size-fits-all demos. Now, they could show the "Upgraders" a seamless migration path while dazzling the "Adopters" with their most innovative features.

Stage 3: The Power of Needs-Based Nuance

The final, and most powerful, layer came from asking why. Why were these companies even looking for a solution? Deeper discovery calls and customer interviews revealed two core needs that drove the final purchase decision, regardless of a company's tech stack.

The most powerful segments aren't just about who a company is or what they do. They're about the fundamental problem they are trying to solve. Understanding this 'job-to-be-done' is the key to creating a message that truly connects.

This needs-based analysis gave them two final, ultra-specific segments:

-

The Cost-Reduction Champions: These companies were laser-focused on the bottom line. Their main goal was to slash operational costs, cut waste, and boost profit margins. The decision-makers here were almost always CFOs or operations managers who lived and breathed spreadsheets.

-

The Sustainability Pioneers: This segment had a different priority: ethical and sustainable sourcing. They were ready to invest in tech that offered supply chain transparency, tracked carbon footprints, and ensured they met environmental regulations.

With these multi-layered B2B market segments in place, ChainFlow's messaging became incredibly precise. They built out detailed profiles for each segment, which acted as their new buyer personas. If you're looking to create these kinds of in-depth customer portraits, our guide on how to create buyer personas is a great place to start.

This new clarity aligned their sales and marketing teams perfectly. They could finally launch targeted campaigns that spoke directly to the unique needs of each audience, leading to a dramatic spike in lead quality and conversion rates.

How to Build Your Segmentation Strategy from Scratch

Building powerful B2B market segments isn't some abstract academic exercise. It's a hands-on process that brings incredible clarity to your entire go-to-market motion. A solid strategy is what separates guessing from knowing—it’s how you move from a hopeful, scattergun approach to a focused, data-backed plan.

Think of it like a master carpenter building a custom piece of furniture. They don't just grab a saw and start cutting. They start with a detailed blueprint, measure twice, and assemble each piece with precision. This section is your blueprint for building a segmentation strategy that actually works.

Define Your Goals and Success Metrics

Before you even think about diving into data, you have to answer a simple question: What are we trying to accomplish? Seriously. What does a "win" look like for your business once this is done? Without a clear destination, you're just wandering in the dark.

Your goals are your compass, and they need to be specific and measurable. Are you trying to boost the quality of your leads? Shorten a notoriously long sales cycle? Maybe you want to crack a new vertical or get more upsell revenue from a certain type of customer.

Here are a few real-world examples of what clear goals look like:

- Increase our MQL-to-SQL conversion rate by 15% in the next six months.

- Cut the customer acquisition cost (CAC) for our enterprise tier by 10% within the year.

- Improve customer retention in the manufacturing sector by 5% over the next fiscal year.

Defining these targets upfront ensures your segmentation work is directly tied to real business outcomes, not just creating neat categories for a slide deck.

Gather and Analyze Your Data

Okay, with your goals set, it's time to put on your detective hat. The best insights live at the intersection of quantitative data (the "what") and qualitative data (the "why"). Your existing systems are an absolute goldmine, if you know where to look.

Start with what you already have. Your CRM is the most obvious and powerful place to begin. It's packed with firmographic and behavioral data on your customers—the ones who love you and the ones who left. Look for patterns. Are your best customers all in a specific industry or of a certain size?

Next, head over to your website analytics. Tools like Google Analytics can show you how different types of companies behave on your site. For example, if you notice that companies from the finance industry are all spending time on your security features page, that’s a huge clue.

Data tells you what happened, but conversations tell you why. The richest insights often come from stepping away from the spreadsheet and talking to actual people.

But don't stop there. The real magic happens when you mix this hard data with human intelligence.

- Interview Your Sales Team: These folks are in the trenches every single day. Ask them which types of companies are a dream to sell to, what pain points keep coming up, and what objections they hear over and over.

- Talk to Customer Success: This team has a direct line to reality. They know which customers are getting massive value and which ones are struggling. Their insights can help you build a profile of a healthy, successful customer.

- Interview Your Best Customers: Go straight to the source. Ask your champions why they chose you, what specific problem you solved for them, and what their buying process really looked like.

This combined approach gives you a complete, 3D picture of your market. It stops you from building your strategy on assumptions or incomplete data.

Create and Profile Your Segments

Now for the fun part: connecting the dots. As you sift through all your research, clear groupings will start to emerge. These are your first-draft B2B market segments. The aim is to create groups that are distinct from one another and substantial enough to be worth your time and effort.

For each segment you identify, build out a detailed profile. This isn't just a list of attributes; it's a living document that brings this customer group to life for your entire company, from marketing to product.

A solid segment profile should always include:

- A descriptive name: Something memorable like "Mid-Market Tech Upgraders" or "Enterprise Sustainability Leaders."

- Firmographics: The basics—industry, company size, annual revenue, and location.

- Key Challenges: What are the biggest business pains that keep them up at night?

- Primary Goals: What are they desperately trying to achieve? What does success look like for them?

- Watering Holes: Where do they hang out online and offline? Think industry publications, LinkedIn groups, or key conferences.

- Key Messaging: A short, tailored value proposition that speaks directly to their pains and goals.

This process is how you turn raw data into actionable intelligence. It gives your sales and marketing teams the exact language and focus they need to have truly relevant conversations.

Test, Refine, and Iterate

Finally, remember that segmentation is not a "set it and forget it" project. Markets shift, customer needs evolve, and your own business will change. Your segmentation strategy has to be a living, breathing thing that you constantly test and refine.

Pick one of your new segments and launch a small, targeted campaign. Track the results like a hawk. Did the messaging land? Were the leads better? Use what you learn to fine-tune your approach. Treat your segments as hypotheses that need to be proven, and never, ever stop listening to the market.

Turning Your Segments into Sales and Marketing Wins

Okay, you’ve done the hard work of creating your B2B market segments. It feels a bit like drawing up a detailed blueprint for a skyscraper—an essential first step. But a blueprint on its own doesn’t actually build anything. Now comes the crucial part: activating those plans and turning them into a coordinated playbook for your sales and marketing teams.

This is where strategy meets action. A brilliant segmentation plan sitting in a slide deck is just a file on a server. Its true value is only unlocked when it starts shaping every ad campaign, every sales call, and every customer interaction. The goal is to create a seamless experience where a prospect feels completely understood at every single touchpoint.

Aligning Marketing for Precision Targeting

For your marketing team, segmentation is the key that unlocks true personalization. It’s how you move from shouting into a crowd to having a meaningful one-on-one conversation. Each segment you've defined has its own set of problems, ambitions, and ways of communicating. Your job is to craft messages that speak directly to that specific reality.

This means you’re no longer running one-size-fits-all campaigns. Instead, you're developing distinct content, ad creatives, and email journeys tailored to each group. The result? You build a connection that resonates on a much deeper level.

Here’s how marketing can put this into practice:

- Personalized Ad Campaigns: On LinkedIn, target your "Cost-Reduction Champions" segment with ads that scream ROI. At the same time, show your "Sustainability Pioneers" content about ethical sourcing and eco-friendly impact.

- Tailored Website Experiences: Use dynamic content on your homepage. When a visitor from the manufacturing industry lands on your site, they see a completely different headline and hero image than someone from the finance sector.

- Segment-Specific Email Nurturing: Create email sequences that directly address the unique challenges of each group, guiding them with content that solves their most pressing problems right now.

The real aim here is to make each prospect feel like you built your solution just for them. Segmentation gives you the roadmap to create that feeling at scale, which naturally leads to higher engagement and better-quality leads.

Empowering Sales with Actionable Intelligence

Over on the sales side, segmentation is a powerful tool for focus and efficiency. It’s the end of treating every lead as equal. Now, your sales reps can immediately spot high-value prospects and tailor their pitch from the very first conversation. The entire sales process shifts from being reactive to powerfully proactive.

Imagine this: a sales rep sees a new lead belongs to your "Legacy System Upgraders" segment. They can instantly skip the pitch on futuristic bells and whistles. Instead, they can lead the conversation with what that prospect actually cares about—seamless data migration, low-risk implementation, and quick user adoption. That immediate relevance builds trust and can dramatically shorten the sales cycle.

This level of personalization is becoming standard practice, especially with the rise of AI and automation in B2B. For example, 34% of B2B buyers in manufacturing and logistics are already using or looking into AI for task automation. Meanwhile, 27% in financial services are using it to create personalized content. Mid-market B2B buyers are particularly bought in, with 46% seeing AI as a major game-changer.

A Unified Go-To-Market Playbook

The biggest wins, however, come when sales and marketing are perfectly aligned around your B2B market segments. This shared understanding creates a consistent, coherent customer journey—from the very first ad they see to the final proposal they sign.

To get there, both teams need a shared playbook that spells out the strategy for each key segment. This is foundational for building effective demand generation strategies that attract and convert the right customers. When everyone is speaking the same language and pulling in the same direction, your segmentation strategy becomes a true engine for growth.

Your B2B Market Segmentation Questions, Answered

Alright, so we've covered the theory. But moving from a concept on a slide deck to a real-world strategy is where the rubber meets the road. It’s also where the most common and practical questions pop up.

Think of this section as a quick chat with a seasoned pro. We'll tackle the nagging questions that often come up right before you dive in, clearing up any confusion and making sure you feel confident in your approach.

How Many B2B Segments Should We Actually Have?

This is easily the most common question I get, and the honest answer is: there's no magic number. The right amount depends entirely on your business, your market, and what your team can realistically handle. The biggest mistake I see is companies getting overzealous and creating a dozen segments right out of the gate, which just stretches everyone too thin.

Instead of chasing a specific number, start small and focused. For most businesses, kicking off with three to five well-defined segments is the sweet spot. It’s manageable. It lets you go deep with each group, really nailing the messaging and creating campaigns that resonate, without burning out your team.

It's far better to be the perfect solution for a few core segments than a mediocre option for ten. Quality and relevance will always beat quantity.

You can always get more granular later as you grow and gather more data. The key is that every single segment you define must be distinct, measurable, accessible, and big enough to be worth the effort.

What Are the Most Common Segmentation Mistakes?

Even with a solid plan, it’s surprisingly easy to trip up when you're building out your first B2B market segments. Knowing what the common pitfalls look like is the best way to steer clear of them.

Here are the four biggest mistakes teams consistently make:

- Relying only on firmographics: Sticking to basic company size and industry is a rookie move. It completely ignores the why behind a purchase—the customer's needs and behaviors. This leads to generic messaging that just doesn't land.

- Creating impractical segments: This one goes both ways. Some teams create segments that are too vague to be useful (like "innovative companies"), while others get so specific they're too small to be profitable. If you can't build a real strategy around a segment, it’s not a real segment.

- Treating segmentation as a one-and-done project: Markets shift, and your customers' needs evolve. Your segmentation model can't be a static document you create once and file away. It needs to be a living, breathing part of your strategy that you revisit and refine regularly.

- Failing to align sales and marketing: This is the big one. If your sales and marketing teams aren't on the exact same page with your segments, you'll have inconsistent messaging and a clunky customer experience. It’s a guaranteed way to waste a ton of effort.

Which Tools Are Best for B2B Market Segmentation?

You don’t need a massive, complicated tech stack to get started, but a few core tools are non-negotiable for gathering data and putting it to work. Your Customer Relationship Management (CRM) platform—think Salesforce or HubSpot—is your mission control. It's the central source of truth for all your customer data and the foundation for everything else.

From there, you can layer on other tools to get more specific insights:

- Web Analytics: A tool like Google Analytics is invaluable. It shows you exactly how different types of companies are interacting with your website, giving you hard data on their behavior.

- Marketing Automation: Platforms such as Marketo or Pardot are what let you turn your segments into action, automating personalized campaigns at scale.

- Business Intelligence (BI): For digging deeper, BI tools like Tableau are fantastic. They help you visualize complex data and spot patterns you might otherwise miss.

- Customer Data Platforms (CDPs): As you get more advanced, a CDP becomes essential for creating that single, unified view of each customer across every touchpoint.

How Is B2B Segmentation Different from B2C?

While they both involve grouping audiences, the way you get there is worlds apart. B2C segmentation often hinges on personal details—demographics like age and gender, or psychographics like hobbies and personal values.

B2B segmentation, on the other hand, is all business. It’s built on firmographics (industry, company size, annual revenue), what technology they’re using, and the complex web of a corporate buying committee. In the B2B world, you're almost never selling to just one person. You're selling a solution to a team of stakeholders involved in a long, rational, and data-heavy decision-making process.

Ready to stop guessing and start targeting the right decision-makers in the Nordics? Nordic Lead Database offers the most extensive database of companies and contacts to power your B2B segmentation strategy. Find your perfect-fit customers and start building a high-quality pipeline today.