At its core, Customer Acquisition Cost (CAC) is simply what you spend to get a new customer through the door. The standard formula is pretty straightforward: you take your total sales and marketing costs over a specific period and divide that by the number of new customers you brought in during that same time.

But don't let the simple math fool you. Truly getting a handle on this number is one of the most critical things you can do for your business. It's the key to unlocking sustainable growth.

Why Mastering Your CAC Is a Game Changer

I've seen it time and again: companies obsess over revenue and customer numbers, but they completely ignore the cost of that growth. Thinking about your CAC isn't just a bean-counting exercise; it's a vital sign for your company's health and scalability. It’s the price you pay for growth, and if that price is too high, you can actually grow yourself right out of business.

Knowing your CAC gives you the power to make smarter, data-backed decisions that ripple across your entire company. It’s a metric that finds its way into almost every strategic conversation, from hammering out the next marketing budget to figuring out which sales channels are actually worth the effort.

Getting this right helps you do a few key things:

- Optimize Your Marketing Budget: When you know what it costs to land a customer from Google Ads versus, say, your content marketing efforts, you can stop guessing. You can shift your money to the channels that are actually making you money.

- Prove Your Business Model Works: Investors and stakeholders always look at the relationship between your CAC and Customer Lifetime Value (LTV). A solid ratio shows them you've built a machine that doesn't just attract customers, but does so profitably.

- Spot Inefficiencies: Is your CAC creeping up? That's often a red flag. It could signal a leaky sales funnel or a marketing strategy that's gone stale, giving you a clear signal on where to focus your attention for improvement.

The Soaring Cost of Gaining a Customer

Flying blind on your CAC is more dangerous now than ever before. The reality is, it's getting more expensive to win new business. That puts a ton of pressure on companies to be smarter and more efficient with every dollar they spend.

Customer Acquisition Cost has surged by an astonishing 222% between 2013 and 2025. What does that mean in real terms? Brands that were losing an average of $9 per new customer in 2013 are now losing around $29 per acquisition. You can read more about the rising acquisition costs and what's behind them.

This isn't just a random spike. It's the result of more expensive ad placements, fierce competition for eyeballs, and customer journeys that are getting more complicated by the day. The old playbook of just throwing more money at marketing and hoping for the best is officially dead.

The companies that thrive today are the ones focused on profitable growth. And that journey always starts with knowing your numbers inside and out. Understanding this reality is the first crucial step before we even get to the formula.

How to Calculate Customer Acquisition Cost Accurately

Alright, let's get our hands dirty and actually calculate this thing. The basic idea is simple, but the devil is in the details. Getting this right is the difference between a vague guess and a powerful metric that actually guides your business strategy.

At its core, the CAC formula is straightforward: you add up all your sales and marketing costs over a specific period and divide that sum by the number of new customers you brought in during that same window.

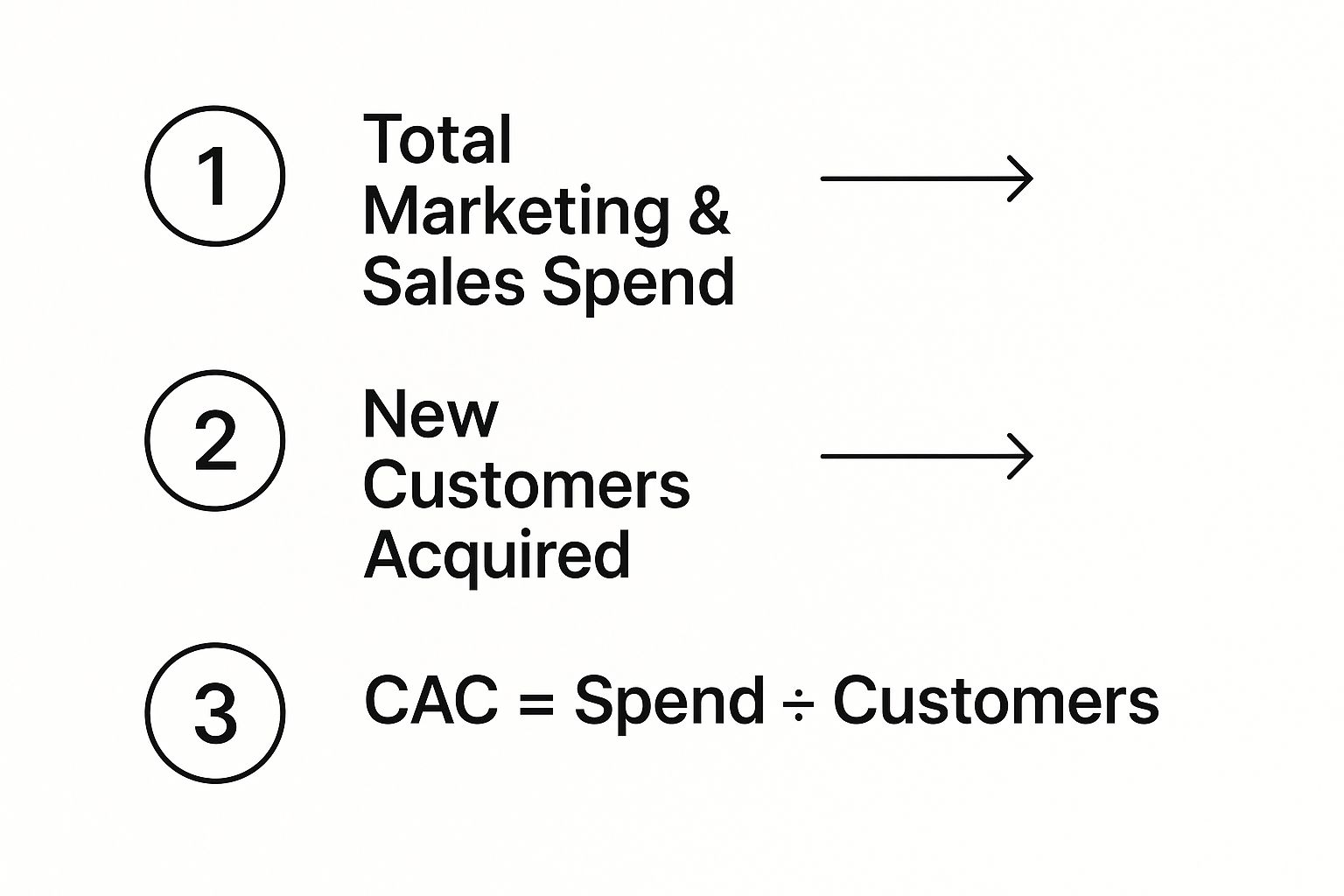

Think of it as a three-part flow: gather all your costs, count up your new customers, and then do the division. Simple enough, right?

The tricky part is making sure you’re comprehensive with those costs. We're not just talking about ad spend here. The calculation needs to include everything from salaries and software fees to commissions. For a deeper dive into what makes up this formula, improvado.io has a great breakdown.

This visual really simplifies the process into its three core stages.

As you can see, the whole thing hinges on having accurate inputs. Garbage in, garbage out.

Tallying Your Total Sales and Marketing Spend

The first piece of the puzzle is Total Costs. This is where I see most people go wrong—they just grab their ad spend numbers and call it a day. To get a true CAC, you have to be brutally honest and include everything.

Make sure your list is this comprehensive:

- Salaries: The full compensation packages for your entire sales and marketing teams.

- Ad Spend: Every dollar spent on paid channels. Think Google Ads, social media campaigns, sponsorships, you name it.

- Content Creation Costs: Did you hire a freelancer for blog posts? Pay a video editor? It all goes in.

- Software and Tools: This is a big one. Subscription costs for your CRM, marketing automation platforms like HubSpot, analytics tools, and anything else your teams use to get the job done.

- Overhead: A reasonable portion of office rent, utilities, and other general business costs that support your sales and marketing functions.

My Two Cents: The most common mistake I see is forgetting to include salaries and software subscriptions. Leaving these out will make your CAC look artificially low, giving you a false (and dangerous) sense of confidence in your acquisition efforts.

A Practical SaaS Startup Example

Let's walk through a real-world scenario. Imagine a B2B SaaS startup is calculating its CAC for the third quarter.

First, they have to round up every single relevant expense from that period. It looks something like this:

- Marketing Team Salaries: $45,000

- Sales Team Salaries & Commissions: $60,000

- Google & LinkedIn Ad Spend: $25,000

- Marketing & Sales Software (CRM, etc.): $5,000

- Content & Design Freelancers: $5,000

Now, they just need to add it all up to get their total spend for Q3.

Total Costs = $45,000 + $60,000 + $25,000 + $5,000 + $5,000 = $140,000

During that same three-month period, all their hard work successfully brought in 200 brand-new paying customers.

With both pieces of the puzzle, they can finally run the calculation:

CAC = $140,000 / 200 = $700

So, what does this tell them? For every single customer they acquired in Q3, it cost the company $700. Now they have a solid, data-backed number they can use as a benchmark to improve against in Q4.

Gathering the Right Data for Your Calculation

Let’s be honest: your CAC calculation is only as good as the numbers you put into it. Garbage in, garbage out. If you're working with incomplete or just plain wrong data, you’ll end up with a CAC that’s dangerously misleading. That’s a fast track to making bad business decisions.

Building a solid process for gathering this data is foundational. It's not the most glamorous work, but it's what separates the companies that scale intelligently from those that burn cash. The goal is to get all your systems talking to each other so you have one clear, unified picture of your costs and customer growth.

Your Primary Data Sources

So, where do you actually find these numbers? Most of the time, the data is scattered across a few key platforms. Your job is to play detective and pull the right pieces of the puzzle together.

Here are the usual suspects you'll need to investigate:

- Customer Relationship Management (CRM): This is where your customer data lives. Think Salesforce or HubSpot. Your CRM will give you the definitive count of "New Customers Acquired" for whatever period you're measuring.

- Advertising Platforms: All your direct ad spend is tracked here. You’ll need to pull cost reports from places like Google Ads and Meta Ads to get a handle on what you're spending to get in front of people.

- Analytics Tools: Software like Google Analytics is crucial for attribution. It helps connect the dots between your marketing efforts and actual customer sign-ups, showing you which channels are really pulling their weight.

- Accounting Software: This is where you'll find the less obvious (but equally important) costs. Your accounting platform, like QuickBooks or Xero, tracks team salaries, software subscriptions, and other operational expenses that belong in your CAC formula.

The biggest mistake I see teams make is focusing only on ad spend. A truly accurate CAC includes the salaries of your sales and marketing teams and the monthly cost of the software they use. Forgetting these costs can make your CAC seem 50% lower than it actually is.

Maintaining Data Integrity and Consistency

Once you know where to look, the next battle is making sure the data is actually clean. A messy database will sink your efforts before you even start. For example, what happens if your CRM logs a "new customer" the moment they sign a contract, but your billing system only counts them after the first payment? You'll get conflicting numbers and a skewed CAC.

To avoid this, you need to get everyone on the same page. Set clear, company-wide definitions for key terms. What officially qualifies as a "new customer"? When is a cost officially "recognized"?

This is all about proactive data hygiene. Regularly cleaning your databases and tackling discrepancies is non-negotiable. If you're struggling, here's a helpful resource to solve data quality problems your essential guide to building trust in your numbers.

When you create a standardized process for collecting and verifying your data, you build a foundation you can rely on. It ensures that every time you run a customer acquisition cost calculation, the result is a number that can genuinely help steer your company’s growth.

What Your CAC Is Actually Telling You

So, you've calculated your Customer Acquisition Cost. Great. But that number—say, $50—is pretty useless on its own. For one company, a $50 CAC could be a massive win. For another, it could signal a fast track to going out of business.

The real magic happens when you give that number some context. Your CAC is only one half of a critical equation. The other half? Customer Lifetime Value (LTV). LTV is the total revenue you expect to bring in from a single customer over the entire time they do business with you. It’s the long-term return on that initial acquisition cost.

The LTV to CAC Ratio: Your Business Health Score

When you put LTV and CAC together, you get the LTV to CAC ratio. Frankly, this is one of the most vital metrics for any growing company. It answers the million-dollar question: is your business model actually sustainable? Are you spending money to attract customers who will eventually pay you back and then some?

A healthy business always generates significantly more value from a customer than it costs to get them in the door. If your ratio is low, it’s a red flag that you might be overspending for unprofitable growth.

As a solid rule of thumb, you want to see an LTV to CAC ratio of at least 3:1. This is the sweet spot. It means you have a scalable model that covers your acquisition costs, pays for overhead, and still leaves a healthy profit on the table.

This ratio acts as a powerful lens, giving you a clear view of your entire marketing and sales operation. It’s a direct reflection of how well your funnel is performing. To get a better feel for this, it's helpful to understand typical sales funnel conversion rates and see how you stack up.

Here’s a quick guide to help you make sense of your own ratio.

Interpreting Your LTV to CAC Ratio

| LTV:CAC Ratio | What It Means | Recommended Action |

|---|---|---|

| Below 1:1 | You're losing money with every new customer. This is a five-alarm fire. | Immediately pause or drastically rethink your acquisition channels. Focus on optimization. |

| 1:1 | You're breaking even on acquisition costs, but you aren't making any profit. | Your business isn't growing; it's just treading water. It's time to work on improving LTV or cutting CAC. |

| 3:1 | This is the ideal benchmark. Your business model is solid, profitable, and sustainable. | You've found a good balance. Continue optimizing, but you have a strong foundation for growth. |

| 5:1 or higher | You're getting incredible returns, but you might be underinvesting in growth. | Your marketing is highly efficient. Consider ramping up your spending to acquire customers faster. |

Essentially, this single number tells a story about your business's viability.

How Does Your CAC Stack Up? Benchmarking Is Key

Context is everything. Your CAC will naturally vary depending on your industry, business model, and who you're selling to. Acquiring a customer for a high-end B2B software platform will almost always cost more than for a direct-to-consumer t-shirt brand.

Knowing the typical costs in your space helps you set realistic goals. In ecommerce, for instance, the customer acquisition cost calculation is a cornerstone of financial planning. As of 2025, the average ecommerce CAC hovers around $70 globally. But that number can swing wildly by niche. You can discover more insights about ecommerce CAC to see just how much it can vary.

Comparing your costs to industry benchmarks helps you answer crucial questions. Are you in line with your competitors? Are you way ahead of the curve, or is there a lot of room for improvement? This context is what turns a simple number into intelligence you can actually use.

Proven Strategies to Lower Your Acquisition Costs

Once you’ve nailed down your customer acquisition cost calculation, the real fun begins. The goal isn’t just to slash your budget; it’s about spending smarter to get more bang for your buck. A lower CAC is a direct line to better profitability and a more sustainable way to grow your business.

It all comes down to finding efficiencies without killing your momentum. This usually means a combination of tweaking what you're already doing and exploring new, more cost-effective avenues. You’d be surprised how small, strategic changes can have a massive impact on your bottom line.

Enhance Your Conversion Rate Optimization

One of the fastest ways to bring down your CAC is to get more out of the traffic you already have. Think about it: if you can double your conversion rate, you've essentially cut your cost to acquire a customer in half. And you did it without spending a single extra dollar on advertising.

I always tell people to start with their highest-traffic landing pages. Is the offer crystal clear? Is the call-to-action (CTA) actually compelling? Sometimes, tiny tweaks to a headline or a button color can make a world of difference.

Here are a few practical places to start:

- Implement A/B Testing: Stop guessing what works. Systematically test different headlines, images, and page layouts to see what truly moves the needle with your audience.

- Improve Page Load Speed: We live in an impatient world. A slow website is a conversion killer, plain and simple. Every second counts.

- Simplify Forms: Only ask for the information you absolutely need right now. Every extra field you add to a form is another reason for someone to give up and leave.

When you make it easier for people to say "yes," every marketing dollar you spend automatically becomes more effective.

I’ve seen teams obsess over driving more traffic when the real problem is a leaky bucket. Fixing your conversion funnel is often the highest-leverage activity you can undertake to improve your CAC.

Refine Ad Targeting and Channel Mix

Nothing inflates acquisition costs faster than broad, untargeted ad campaigns. You're just paying to show your ads to people who were never going to buy from you in the first place. The key is to get laser-focused on your ideal customer profile (ICP).

Get deep into your analytics. Find out which channels and specific campaigns are giving you the best LTV:CAC ratio. Double down on what's working and be ruthless about cutting what isn't. It's not uncommon to find that a smaller, niche channel actually outperforms a big, expensive one.

This is also a great time to lean into organic channels. Paid ads are great for immediate results, but they're a constant expense. Content marketing and SEO, on the other hand, are about building a long-term asset that keeps paying you back. Creating genuinely helpful content that solves your audience's problems is a powerful way to generate leads at a much lower cost over time.

Leverage Customer Retention and Referrals

It's an old saying because it's true: it is almost always cheaper to keep a customer than to find a new one. A solid retention strategy not only boosts your customer lifetime value (LTV) but can also lower your CAC indirectly. Why? Because happy, loyal customers become your best advocates.

Setting up a simple referral program is one of the most powerful tactics here. By giving your current customers a reason to spread the word, you turn them into a low-cost sales force. A customer who comes in through a referral has a CAC that’s close to zero, which can pull your overall blended CAC down significantly.

This approach is so effective because it’s built on trust. A recommendation from a friend will always be more credible than any ad you could ever run. It's an incredibly efficient path to healthy, sustainable growth.

Answering Common Questions About Calculating CAC

https://www.youtube.com/embed/TCGwdcPCIzc

Even with a straightforward formula, things can get a bit fuzzy when you start digging into the details of your customer acquisition cost. Getting the little things right is what separates a vague guess from a number you can actually build a strategy around. Let's walk through some of the questions that pop up most often when teams start tracking this metric.

Think of it this way: a small miscalculation now can lead to a big, expensive mistake down the road.

How Often Should I Calculate My Customer Acquisition Cost?

The right cadence for calculating CAC really comes down to the speed of your business. If you're in a fast-paced space like SaaS or ecommerce, you’ll want to run the numbers monthly. This lets you see the impact of new campaigns almost immediately, spot trends as they emerge, and pivot your strategy before you sink too much money into a channel that isn't working.

Looking at it quarterly is also a smart move. It smooths out any weird monthly blips and gives you a more stable, big-picture view of your performance. While an annual calculation is fine for high-level financial reports, it’s way too slow for making nimble, tactical decisions during the year.

The most important thing isn't the specific interval but consistency. Choose a schedule and stick to it. That's how you build a reliable benchmark and start making meaningful comparisons over time.

What Are the Most Common Mistakes to Avoid?

I see a few common tripwires that can really throw off a CAC calculation. The biggest one by far is forgetting to include all the costs. It's easy to just count your direct ad spend, but what about the salaries of your marketing and sales team? Or the subscription costs for your CRM, analytics tools, and other marketing software? Those are all part of the cost of acquiring a customer.

Another classic mistake is a mismatch in timing. If you attribute marketing spend from February to a customer who signed up in March, your monthly numbers are going to be skewed. Make sure your cost and acquisition periods line up perfectly.

Finally, get crystal clear on your definition of a "new customer." Accidentally including returning customers in your count will artificially deflate your CAC, making you think your acquisition engine is more efficient than it really is.

Should My CAC Calculation Include Costs for Acquiring Free Users?

This is a fantastic question, and the answer depends entirely on your business model. If you run on a freemium model where free users are the primary pipeline for paid conversions, then you absolutely should include those costs.

Here’s the right way to approach it:

- Your Total Marketing & Sales Cost should cover everything you spent to get both free and paid users in the door.

- But, your New Customers Acquired number should only count the new paid customers.

This method ensures you're calculating the true cost to acquire someone who actually pays you. If your free users aren't a direct funnel to sales, it might make sense to calculate two separate numbers: a "paid-only CAC" and a "blended CAC" to see how different strategies are performing.

Ready to stop guessing and start targeting the right customers? Nordic Lead Database offers the most extensive database of decision-makers and companies in the Nordics, helping your sales team connect with high-value prospects efficiently. Find your next customer today.