In the competitive SaaS landscape, generic outreach falls flat. To effectively penetrate the Nordic market, your sales team needs precision targeting fueled by sophisticated customer segmentation strategies. A one-size-fits-all approach wastes resources and fails to resonate with discerning Nordic decision-makers. The key to unlocking this high-value market isn't just about what you sell, but who you sell to and how you approach them. This is where a deep understanding of your potential customers becomes your most powerful asset, allowing you to tailor your messaging, product positioning, and sales cadence for maximum impact.

This guide moves beyond theory, providing 10 actionable customer segmentation strategies specifically designed for SaaS teams. We'll explore how to leverage a rich dataset, like a comprehensive Nordic business database, to identify and engage your ideal customer profiles. By implementing these techniques, you can transform your sales process from a wide net into a surgical strike. Get ready to refine your focus, enhance your outreach effectiveness, and drive meaningful revenue growth by connecting with the right prospects at the right time. We will cover everything from firmographic and behavioral data to value-based and technographic insights.

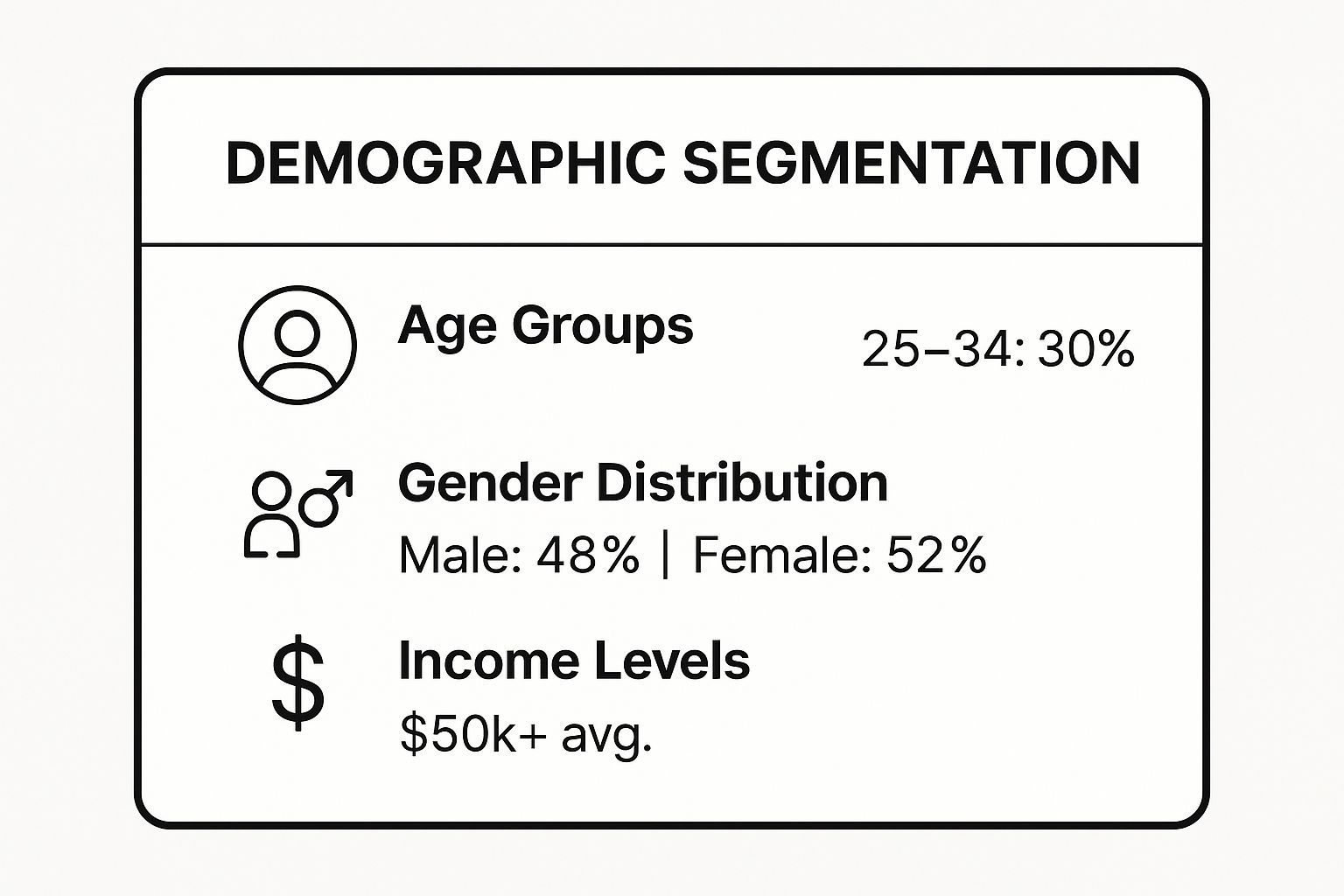

1. Demographic Segmentation

Demographic segmentation is one of the most foundational and widely adopted customer segmentation strategies, organizing your target market based on observable, people-based attributes. This method involves grouping potential customers by variables like age, gender, income, occupation, and education level. For SaaS sales teams, this approach provides a clear, data-driven starting point for understanding who their buyers are in objective terms.

While simple, its power lies in its directness. Knowing the demographic profile of your ideal customer helps tailor messaging and select the right outreach channels. For instance, a fintech SaaS targeting high-income professionals in their 40s would use different language and platforms than a project management tool aimed at recent graduates entering the tech industry.

Actionable Implementation

To effectively apply this strategy, go beyond surface-level data. Instead of just targeting "managers," segment by specific job titles like "Head of Engineering" or "Marketing Director," as their needs and purchasing power differ significantly.

- Refine Your ICP: Use your Nordic decision-maker database to filter contacts by job title, company size, and industry. Cross-reference this with age and gender data to build a multi-layered ideal customer profile (ICP).

- Tailor Outreach: Craft email sequences and call scripts that resonate with specific professional roles. A message to a CFO should highlight ROI and cost savings, while a message to a CTO should focus on technical integration and security.

- Inform Channel Selection: Use demographic insights to choose your outreach platforms. A younger audience of startup founders might be more active on LinkedIn, while older, more established executives may respond better to highly personalized email campaigns.

The following visual provides a quick reference for common demographic data points a SaaS team might track.

This snapshot shows how segmenting by age, gender, and income reveals the core composition of a target audience, allowing for more precise messaging and resource allocation.

2. Psychographic Segmentation

Psychographic segmentation moves beyond "who" your customers are and dives into "why" they make purchasing decisions. This advanced strategy groups prospects based on psychological traits like values, attitudes, interests, and lifestyle. For SaaS sales teams, this means understanding the underlying motivations of a decision-maker, such as their desire for innovation, risk aversion, or focus on personal achievement. It provides a much deeper, more nuanced view of your target market.

This approach is powerful because it helps you connect with prospects on an emotional level. For example, a SaaS tool positioned as a cutting-edge, disruptive technology will resonate with a "tech-forward innovator" persona. In contrast, a tool emphasizing stability, security, and proven ROI appeals to a more "risk-averse traditionalist." Understanding these mindsets is crucial for crafting truly persuasive messaging.

Actionable Implementation

To leverage this strategy, you must infer psychological traits from behavioral and demographic data. A decision-maker who frequently engages with content about AI and industry disruption is likely an innovator.

- Develop Psychographic Personas: Use your Nordic database to identify decision-makers at companies known for rapid growth or early tech adoption. Build personas around traits like "efficiency-driven" or "growth-oriented" based on their industry and company history.

- Align Messaging with Values: For a prospect identified as "status-conscious," frame your SaaS solution as a tool that will elevate their team’s reputation. For a "collaboration-focused" leader, highlight features that enhance teamwork and communication.

- Analyze Content Consumption: Monitor the types of content, webinars, and case studies your prospects engage with. This reveals their professional interests and priorities, allowing you to tailor follow-up conversations to what truly matters to them.

This snapshot visualizes how segmenting an audience by lifestyle and values can reveal distinct groups like "innovators" or "traditionalists," each requiring a unique sales approach.

3. Behavioral Segmentation

Behavioral segmentation moves beyond static attributes to group customers based on their actions and interactions with your product and brand. This powerful customer segmentation strategy analyzes patterns like product usage frequency, feature adoption, purchase history, and engagement with marketing materials. For SaaS sales teams, it provides direct insight into which prospects are most engaged and which current customers are ripe for an upsell.

This approach is highly effective because it’s based on demonstrated intent rather than assumptions. By understanding what users do, you can predict what they will need next. For example, a user who repeatedly accesses advanced reporting features is a strong candidate for an enterprise-tier upgrade, while one whose usage has declined may be at risk of churning.

Actionable Implementation

To leverage this strategy, you must have robust tracking mechanisms in place. The goal is to connect user actions directly to sales opportunities and retention efforts.

- Identify Key Behaviors: Define actions that signal high value or purchase intent, such as completing a product tour, inviting team members, or using a premium feature during a trial.

- Create Action-Based Segments: Use your CRM and product analytics to build dynamic lists. Create segments for "power users," "infrequent users," and "trial users who used X feature" to tailor your outreach.

- Automate Triggers: Set up automated email sequences or sales alerts based on behavior. For instance, if a decision-maker from your Nordic database repeatedly visits the pricing page after a demo, trigger a notification for their account executive to follow up immediately.

The following video offers a deeper dive into the mechanics and benefits of applying behavioral data to your marketing and sales funnels.

By focusing on what customers do, behavioral segmentation allows for highly relevant and timely communication, dramatically increasing conversion and retention rates.

4. Geographic Segmentation

Geographic segmentation divides a market based on physical location, such as country, city, or climate zone. This approach is powerful because consumer needs, cultural norms, and economic conditions can vary dramatically from one place to another. For SaaS sales teams targeting a broad region like the Nordics, this strategy is essential for adapting outreach to local market dynamics.

Recognizing these distinctions allows for more relevant and effective engagement. For example, a compliance SaaS would approach a potential client in Norway, which is not an EU member, differently than one in Finland or Sweden, which are. These location-based nuances directly impact pain points, regulatory requirements, and purchasing drivers, making geographic customer segmentation strategies critical for international success.

Actionable Implementation

Use location data to tailor your sales process, from initial contact to closing the deal. This demonstrates a deep understanding of the prospect's specific business environment.

- Adapt to Local Regulations: Filter your Nordic decision-maker database by country. Customize your value proposition to address country-specific data privacy laws (like GDPR variations) or industry regulations that affect your prospects.

- Localize Communication: Tailor your messaging to reflect local business etiquette, holidays, and language preferences. Acknowledging a national holiday in Denmark or using a local case study shows you’ve done your homework.

- Align with Economic Conditions: Monitor regional economic trends. Emphasize cost-saving features in a region experiencing economic tightening, while highlighting innovation and growth potential in a booming local market.

5. Value-Based Segmentation

Value-based segmentation is a powerful strategy that groups customers based on their economic worth to your business. This method prioritizes outreach by focusing on high-value accounts, typically measured by customer lifetime value (CLV), average revenue per user (ARPU), or overall profitability. For SaaS sales teams, it ensures that your most significant resources are allocated to prospects with the highest potential return.

This approach shifts the focus from "who" the customer is to "what" their value is. A small startup with high growth potential and a large budget might be more valuable than a massive enterprise with low engagement and a restrictive budget. This makes it one of the most effective customer segmentation strategies for driving revenue growth and maximizing sales efficiency.

Actionable Implementation

To implement this strategy, you must first define what "value" means for your business. Is it high initial contract value, long-term retention, or potential for upselling? Once defined, you can segment your prospects accordingly.

- Calculate Customer Value: Analyze your existing customer data to calculate CLV. Identify the common firmographic and behavioral traits of your most profitable customers, such as company size, industry, and product usage patterns.

- Tier Your Prospects: Use your Nordic decision-maker database to filter prospects that match the profile of your high-value customers. Create tiers (e.g., Tier 1: High-Value, Tier 2: Medium-Value) to guide your team's prioritization and effort.

- Align Service and Outreach: Dedicate your most experienced sales reps to Tier 1 prospects, offering them personalized demos and high-touch engagement. For lower-value tiers, you might use more automated sequences. This tiered approach is a core component of successful demand generation strategies.

6. Firmographic Segmentation

Firmographic segmentation is the B2B equivalent of demographic segmentation, organizing your target market based on company-level attributes. This powerful strategy involves grouping business customers by variables like industry, company size, annual revenue, and geographic location. For SaaS sales teams, this is one of the most critical customer segmentation strategies for identifying and prioritizing high-value accounts.

Its effectiveness lies in its ability to directly correlate company characteristics with specific needs and purchasing power. A startup with 10 employees has vastly different challenges and budget constraints than a multinational corporation with 10,000 employees. Understanding these firmographic details allows you to tailor your solution’s value proposition, pricing, and sales approach to fit the prospect’s operational reality perfectly.

Actionable Implementation

To apply this strategy, move beyond basic industry classifications. Instead of targeting the entire "software" industry, segment by niche verticals like "FinTech" or "HealthTech" and cross-reference with company size to pinpoint your ideal accounts.

- Define Target Segments: Use your Nordic decision-maker database to filter companies by employee count, revenue, and industry classification. For example, target manufacturing companies with 200-500 employees and over €50 million in revenue.

- Align Sales Approach: Develop distinct sales motions for different segments. An enterprise sales cycle for a large corporation requires a multi-threaded approach involving multiple stakeholders, while a small business might be a quick, single-contact sale.

- Customize Messaging: Craft outreach that speaks to segment-specific pain points. A message to a rapidly growing scale-up should focus on scalability and integration, while a message to a stable, established enterprise should highlight efficiency gains and security.

7. Needs-Based Segmentation

Needs-based segmentation is a powerful customer-centric strategy that groups customers based on the specific problems they are trying to solve or the "jobs" they need to get done. This approach moves beyond who the customers are (demographics) or what they do (behavioral) to understand why they are seeking a solution. For SaaS sales teams, this means focusing on the underlying motivations driving a purchase.

This strategy is highly effective because it directly addresses the value proposition. A company like Intuit QuickBooks, for example, serves different needs: a freelancer needs simple invoicing, while a growing small business needs comprehensive payroll and inventory management. By segmenting based on these distinct needs, your sales messaging can speak directly to the core pain points of each group, making your outreach far more resonant and effective.

Actionable Implementation

To implement this strategy, you must uncover the functional and emotional drivers behind a customer's purchasing decision. This involves deep qualitative research to understand their goals and challenges.

- Conduct Customer Interviews: Use the "Jobs-to-be-Done" framework to ask probing questions. Instead of asking what features they want, ask about the progress they are trying to make and what obstacles are in their way.

- Map Need-Based Personas: Create personas not based on job titles but on distinct need states. For example, a "Compliance-Driven Buyer" has different needs than an "Efficiency-Focused Innovator," even if they work at similar companies.

- Align Sales Messaging: Tailor your sales pitches to solve the specific job a prospect is "hiring" your SaaS for. This focused approach is critical when you build your sales pipeline because it ensures every conversation is centered on delivering tangible value to the prospect's unique situation.

8. Technographic Segmentation

Technographic segmentation groups customers based on the technology they use, from their software stack and hardware to their digital behavior and technical sophistication. For SaaS companies, this is one of the most powerful customer segmentation strategies available, as it directly relates to product compatibility, integration potential, and a prospect's readiness to adopt a new solution. Understanding a company's tech stack tells you if they are a good fit before you even make the first call.

This method allows you to identify companies that use complementary or competing technologies. For instance, knowing a prospect uses a specific CRM allows you to highlight your native integration with it, immediately demonstrating value. Conversely, identifying a user of a competitor’s software provides a clear opportunity for a displacement campaign focused on your superior features and ROI.

Actionable Implementation

Leverage technographic data to create highly relevant and timely outreach that speaks directly to a prospect’s existing technology environment. This positions your solution not as a standalone product, but as a seamless addition to their current workflow.

- Identify Integration Opportunities: Use your Nordic decision-maker database to filter companies by the specific software they use (e.g., Salesforce, HubSpot, Slack). Tailor your pitch to showcase how your tool enhances their existing stack.

- Target Competitor Users: Create segments of companies using a direct competitor’s product. Develop messaging that highlights your key differentiators and addresses common pain points associated with that competitor. Learn more about effective prospecting for leads using this data.

- Assess Tech Sophistication: Segment prospects by their overall technology adoption level. A company using legacy on-premise systems requires a different sales approach than a cloud-native startup that embraces cutting-edge tools. Adjust your messaging to match their technical comfort level.

9. Life Stage Segmentation

Life stage segmentation is a dynamic approach that groups customers based on their current phase in life, such as being a student, a young professional, a new parent, or a retiree. This strategy acknowledges that a person's needs, priorities, and purchasing behaviors are heavily influenced by major life events and transitions, often more so than by simple demographic data like age. For SaaS sales, this offers a nuanced way to understand customer motivations beyond their professional role.

The power of this method comes from its predictive and empathetic nature. A project management tool, for example, might be positioned differently to a recent graduate focused on individual productivity versus a new manager (a professional life stage) who is suddenly responsible for team collaboration. Recognizing these distinct life phases allows for more relevant and timely outreach that speaks directly to a prospect’s current challenges and goals.

Actionable Implementation

To leverage this strategy, sales teams must look for triggers that indicate a shift in a prospect's personal or professional life. This requires moving beyond static database fields and paying attention to more dynamic signals.

- Identify Life Stage Triggers: Use your Nordic decision-maker database to monitor for job changes, promotions, or company anniversaries. A recent promotion to a leadership role is a significant professional life stage shift that often creates new software needs.

- Create Phase-Specific Messaging: Develop outreach campaigns that align with these triggers. Congratulate a prospect on their new role as "Head of Sales" and introduce your CRM as a tool to help them make an immediate impact in their first 90 days.

- Develop Evolving Solutions: Frame your SaaS product as a solution that grows with a professional's career. Show a startup founder how your tool can scale from a small team to an enterprise-level organization, supporting them at each stage of their company's life cycle.

10. Occasion-Based Segmentation

Occasion-based segmentation is a powerful situational strategy that groups customers based on specific contexts or events when they might need your SaaS solution. This approach acknowledges that a customer's purchasing drivers change depending on the occasion, such as a company merger, a new funding round, a major project launch, or a seasonal business peak. It shifts the focus from who the customer is to when they have a pressing need.

For SaaS sales, this is a highly effective way to time your outreach for maximum impact. A company that just received Series B funding has a different set of needs and a greater urgency to scale its software stack compared to a company in a steady state. Similarly, a retail business entering the Q4 holiday season is more open to solutions that optimize logistics or e-commerce performance.

Actionable Implementation

To leverage this strategy, you must identify trigger events that create an immediate need for your product. These occasions signal a window of opportunity where decision-makers are actively seeking solutions.

- Identify Trigger Events: Use your Nordic decision-maker database and news alerts to track key company events like leadership changes, office expansions, or significant new hires. These events often precede a technology purchasing cycle.

- Create Occasion-Specific Campaigns: Develop outreach sequences tailored to these triggers. For a company that just hired a new Head of Sales, your messaging should focus on how your CRM can help them onboard their team and hit the ground running.

- Align with Business Cycles: Understand the seasonal or cyclical needs of your target industries. A SaaS providing compliance software should increase outreach to financial firms ahead of key regulatory deadlines, as this is a critical occasion for them.

Customer Segmentation Strategies Comparison

| Segmentation Type | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Demographic Segmentation | Low – straightforward and data readily available | Low – uses existing population stats | Basic group differentiation; clear segments | Mass marketing, product development, media buying | Simple, cost-effective, measurable |

| Psychographic Segmentation | High – requires surveys and in-depth analysis | High – qualitative research and data analysis | Deep customer insight; emotional connection | Brand positioning, personalized messaging | Rich insights, predictive, motivational targeting |

| Behavioral Segmentation | Medium-High – needs robust tracking systems | Medium-High – data collection across touchpoints | Highly predictive; real-time actionable segments | E-commerce, digital marketing, customer retention | Data-driven, dynamic, predictive |

| Geographic Segmentation | Low – based on physical data and location info | Low – uses accessible location data | Efficient regional targeting and distribution | Regional marketing, product localization | Easy to implement, cost-effective |

| Value-Based Segmentation | Medium – requires financial modeling | Medium – needs ROI and CLV data | Optimized resource allocation; maximized ROI | Customer prioritization, service segmentation | Business impact driven, prioritizes profitability |

| Firmographic Segmentation | Medium – B2B data gathering and classification | Medium – requires company data sources | Tailored B2B marketing and sales strategies | B2B marketing, account-based marketing | Relevant for B2B, supports strategic sales |

| Needs-Based Segmentation | High – needs qualitative research and customer understanding | High – interviews and journey mapping | Strong alignment with customer value; drives innovation | Product development, customer-centric strategies | Customer-focused, predictive, differentiating |

| Technographic Segmentation | Medium-High – requires digital analytics and data | Medium-High – technology usage tracking | Personalized digital experiences; tech adoption insight | Digital products, software marketing, tech support | Relevant in digital markets, enhances personalization |

| Life Stage Segmentation | Medium – requires monitoring life transitions | Medium – ongoing data updates | More predictive than age; lifecycle marketing | Financial services, retail, insurance | Dynamic, predictive, reflects real customer needs |

| Occasion-Based Segmentation | Medium – situational data collection | Medium – research on usage occasions | Precise targeting for specific contexts/events | Seasonal campaigns, event marketing, hospitality | Enables targeted, timely campaigns, premium pricing opportunities |

From Strategy to Action: Segmenting Your Way to Success

Mastering customer segmentation is not just an academic exercise; it's the engine of a modern, high-performing SaaS sales machine. We've explored ten powerful customer segmentation strategies, from the foundational firmographic and demographic approaches to the more nuanced behavioral and psychographic models. Each strategy offers a unique lens through which to view your target market, transforming a faceless sea of prospects into distinct groups with specific needs, challenges, and motivations.

The true breakthrough, however, doesn’t come from choosing just one. The most successful sales teams understand that these strategies are not mutually exclusive. They are building blocks for a sophisticated, multi-layered targeting system that drives unparalleled personalization and efficiency.

Key Takeaways for Your Sales Strategy

To turn these concepts into tangible results, focus on these core principles:

- Layer, Don't Isolate: The real power emerges when you combine strategies. Start with broad firmographic data (e.g., tech companies in Sweden with 100-500 employees) and layer it with more specific technographic insights (e.g., they use HubSpot and AWS) and behavioral signals (e.g., they recently visited your pricing page). This creates hyper-specific segments ripe for targeted outreach.

- Data is Your Foundation: A brilliant strategy is useless without accurate, up-to-date information. Your ability to execute value-based, needs-based, or life stage segmentation is directly tied to the quality of the data you use to fuel your CRM and sales engagement platforms.

- Start Small and Iterate: Don't feel pressured to implement all ten strategies at once. Choose one or two that most closely align with your current business goals. For instance, if you're launching a new integration, a technographic segment is a logical starting point. Measure the results, learn from the campaign, and gradually build out your segmentation framework.

Your Actionable Next Steps

The journey from generic outreach to precision targeting is a process of continuous improvement. The ultimate goal of adopting these customer segmentation strategies is to ensure that every interaction you have with a potential customer is relevant, timely, and valuable. When you understand who they are, what they need, and when they need it, you stop being just another vendor and become a trusted partner.

This strategic clarity allows you to craft messaging that resonates deeply, allocate your sales resources effectively, and ultimately build stronger, more profitable customer relationships. By moving beyond one-size-fits-all tactics, you position your SaaS solution not just as a product, but as the specific answer to a well-understood problem.

Ready to put these strategies into action with a data source built for precision? The Nordic Lead Database provides the rich firmographic, technographic, and decision-maker data you need to build powerful, multi-layered segments. Stop guessing and start targeting the right Nordic companies today with Nordic Lead Database.