Let’s be honest: in today's B2B world, a one-size-fits-all strategy is a surefire way to get ignored. That’s where market segmentation in B2B comes in. It’s moved from a "nice-to-have" tactic to an absolute must for any business that wants to survive, let alone grow.

The concept is simple: you break down your massive potential market into smaller, well-defined groups of companies that share common traits.

Why Generic B2B Marketing No Longer Works

Trying to navigate the modern B2B world without segmentation is like sailing across an ocean with no map. You're just drifting, burning through your budget and energy, hoping to stumble upon land. The old "spray and pray" method of casting a huge net is officially dead. Today’s business buyers expect you to understand their specific problems and speak their language.

And this isn't happening in a vacuum. The global B2B eCommerce market is on track to hit an incredible $36.16 trillion by 2026—more than double what it was in 2019. More growth means more competition and a lot more noise. Standing out is tougher than ever. If you want to dive deeper, there's some great data on B2B marketing trends on sellerscommerce.com.

Finding Your North Star with Data

So, how do you find the right customers in this crowded sea? You need coordinates. For B2B marketers, those coordinates are built from specific types of data that paint a crystal-clear picture of your ideal customer.

To get segmentation right, you have to get a handle on a few key pillars of information:

- Firmographics: This is the basic company DNA—industry, employee count, annual revenue, and where they're located. It’s essentially demographics, but for businesses.

- Technographics: This is all about the tech stack a company uses. Knowing a prospect is on Salesforce or HubSpot gives your sales team incredible context and a perfect entry point.

- Behavioral Data: This tracks how potential customers interact with you. Are they visiting your pricing page? Did they download that new whitepaper? These are buying signals, plain and simple.

When you combine these data points, you stop shouting into the void and start having real conversations with the companies that are actually a good fit. It’s the difference between hoping for a lead and engineering one.

Skipping this strategic step is just too expensive. You end up burning marketing dollars on people who will never buy, your sales team gets bogged down with dead-end leads, and your message falls flat. On the flip side, companies that truly nail market segmentation in B2B gain a huge advantage. Every dollar spent and every hour invested is done with precision and a clear purpose.

The Four Pillars of B2B Segmentation

To really get B2B market segmentation right, you need a solid framework. Think of it like building a house—you can't just start throwing up walls. You need strong pillars to support the whole structure. For segmentation, these pillars help you slice and dice the market in a way that actually makes sense, letting you build a marketing and sales strategy that won't fall apart.

These aren't just abstract academic theories, either. They're practical models that, when you put them together, give you a rich, multi-dimensional picture of your potential customers. Each pillar answers a different—and equally vital—question about who these companies are and what they really need from you.

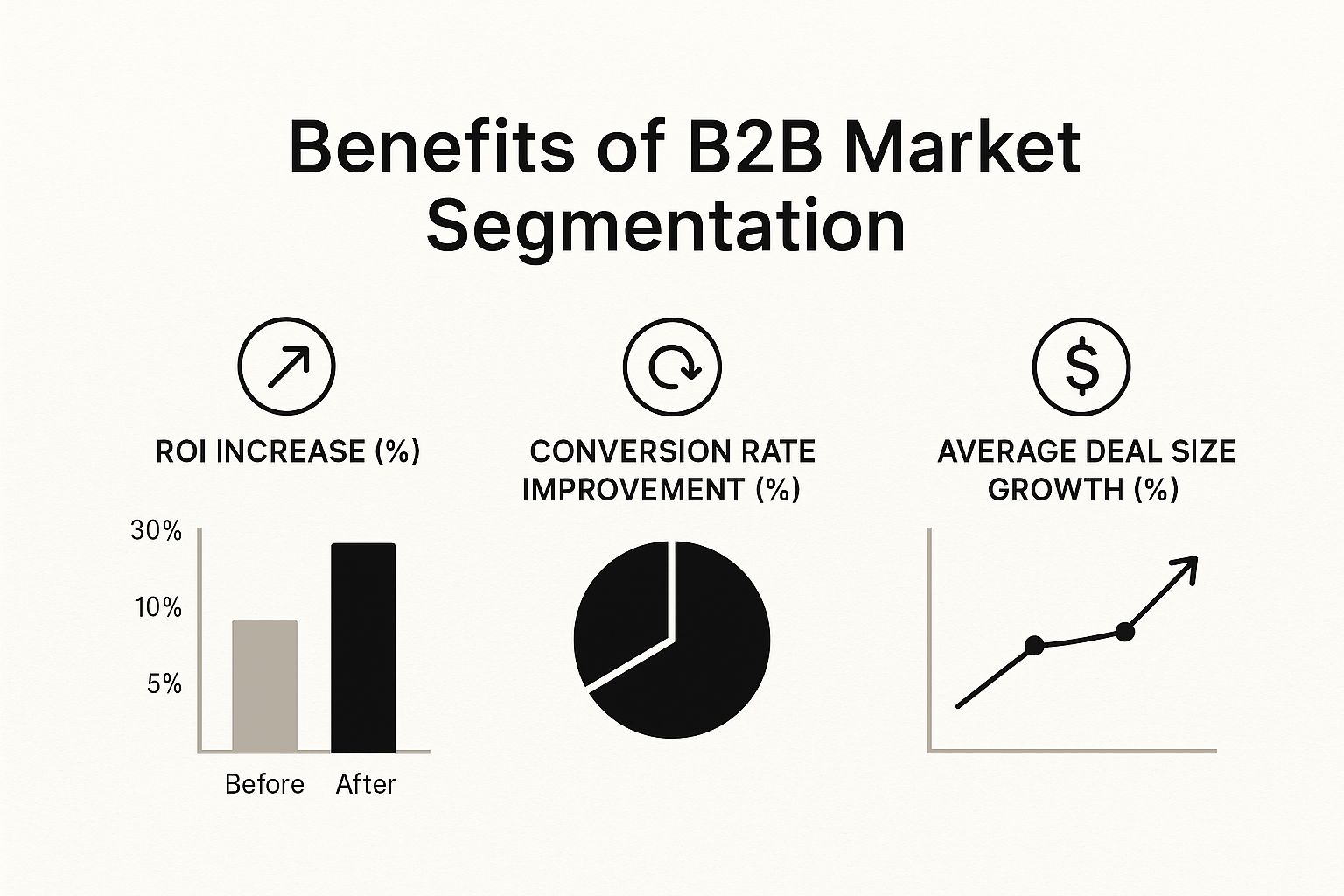

The proof is in the numbers. Just look at the results when companies shift from a one-size-fits-all approach to a properly segmented one. We're talking about major lifts in ROI, conversion rates, and even the size of the deals you close.

As the data shows, moving from a generic broadcast to a targeted strategy isn't just a small tweak; it’s a direct path to tangible growth across the metrics that matter most.

Now, let's break down these four pillars one by one.

1. Firmographics: The "Who" and "Where"

Firmographics are the absolute basics—the DNA of a company. This is the most straightforward pillar, answering the fundamental questions of "who are they?" and "where are they?" It gives you that essential, high-level map of the business landscape and is always the first step in any good segmentation plan.

Some of the most common firmographic data points include:

- Industry: Are you targeting healthcare, manufacturing, or financial services?

- Company Size: Is your sweet spot with startups, mid-market companies, or massive enterprises?

- Annual Revenue: Do you need to focus on companies with a certain budget?

- Geographic Location: Are your customers concentrated in a specific city, region, or country?

For instance, a logistics software company might use firmographics to zero in on manufacturing firms with over $50 million in annual revenue located near major North American shipping ports. Just like that, they’ve cut through the noise and focused their energy on a much more relevant group.

2. Technographics: The "What They Use"

Once you know who they are, you need to know what they use. Technographics dig into a company's technology stack—the software, hardware, and digital tools they rely on. This is incredibly powerful information because it reveals a company's priorities, technical maturity, and potential integration needs.

Knowing a prospect's tech stack lets you have a completely different kind of conversation. Instead of a cold "Do you need a solution like ours?" you can lead with, "I see you use Salesforce, and our tool was built to supercharge it."

Imagine you sell a powerful analytics plugin for HubSpot. Using technographics, you can instantly pull a list of every company that uses HubSpot but doesn't have an advanced analytics tool. Your outreach is no longer a random shot in the dark; it's a perfectly aimed, valuable suggestion.

3. Behavioral: The "How They Engage"

This is where things get really interesting. Behavioral segmentation isn't about who a company is, but what they do. It tracks how prospects and customers interact with your brand, giving you clear signals about their level of interest and intent. It answers the crucial question: "What actions show they might be ready to talk?"

This data is dynamic and tells a powerful story. It includes clues like:

- Website Activity: Which pages are they visiting? How long are they sticking around? What whitepapers are they downloading?

- Email Engagement: Are they opening your newsletters? Clicking on links to case studies?

- Sales Interactions: Did they attend a webinar? Show up for a demo? What kinds of questions did they ask?

A SaaS company might create a "high-intent" segment for anyone who has visited their pricing page three times in a week and also downloaded a technical case study. This group is practically raising their hand. They aren’t just a lead anymore; they're a priority for the sales team to contact immediately.

4. Needs-Based: The "Why They Buy"

Finally, we get to the core motivation: the "why." Needs-based segmentation groups companies by their specific pain points, challenges, and strategic goals. This is the deepest and most powerful form of segmentation because it speaks directly to the reason a customer would ever buy from you in the first place.

While the other pillars tell you who to talk to, this one tells you what to say. It forces you to move beyond features and talk about solutions to real-world problems. For example, within the same industry, you might have:

- The "Efficiency Seekers": These companies are looking for tools to automate manual processes and cut operational costs.

- The "Growth Hackers": This group is focused on scaling quickly and needs solutions for customer acquisition and market expansion.

- The "Compliance-Driven": These businesses operate in regulated industries and their primary need is for tools that ensure security and data privacy.

Tailoring your messaging to the "Growth Hackers" by highlighting scalability is far more effective than giving them the same pitch you give to the "Compliance-Driven" crowd. This is how you make your marketing resonate on a personal level.

To help you keep these models straight, here's a quick cheat sheet.

Key B2B Segmentation Models at a Glance

This table breaks down the four primary models, highlighting what data they use and where they shine the brightest.

| Segmentation Model | Key Variables | Best Used For |

|---|---|---|

| Firmographic | Industry, company size, revenue, location | Building a foundational, high-level view of your total addressable market. |

| Technographic | Software used, hardware, tech stack | Identifying integration opportunities and tailoring product-specific messaging. |

| Behavioral | Website visits, email clicks, content downloads, demos | Scoring leads, identifying buying intent, and triggering timely sales outreach. |

| Needs-Based | Pain points, strategic goals, desired outcomes | Crafting highly resonant value propositions and personalized marketing campaigns. |

As you can see, each model provides a unique lens. The real magic happens not when you pick one, but when you layer them together to create a truly comprehensive and actionable view of your market.

Building Your B2B Segmentation Framework

Alright, we’ve covered the what and the why. Now, let's get into the how. Moving from understanding segmentation models to actually putting them to work requires a structured, repeatable process. A solid framework is what turns all that raw data into a real go-to-market plan, making sure your efforts are strategic, not just speculative. It’s the bridge between theory and results.

The very first step? Define what success looks like for you. Your segmentation work needs to be tied to clear business objectives. Are you trying to break into a new industry, reduce customer churn, or just make your sales team more efficient? Without a clear goal, you're just sorting data for the fun of it.

This initial clarity is everything because it tells you exactly what kind of data you need to find. Your CRM and analytics platforms are gold mines, full of firmographic, technographic, and behavioral clues about your best customers. This data isn't just nice to have; it's the foundation of your entire strategy.

Gathering and Analyzing Your Data

Once your objective is set, it’s time to hunt for the right information. The best place to start is right in your own backyard—with your existing customers. Who are your most profitable, loyal, and successful clients? Pull reports from your CRM and look for the common threads. Are they all in the same industry? A similar size? The same geographic region?

Next, you'll want to layer on behavioral data from your marketing automation platform and website analytics. This is where you start connecting the dots.

Look for patterns by asking questions like:

- Which industries seem to binge-read your blog or download your whitepapers?

- Do your highest-value customers all use a specific technology, like Salesforce or Marketo?

- What specific actions on your website tend to happen right before a deal closes?

This kind of analysis is what moves you from gut feelings to data-backed insights. We know market segmentation in B2B is so crucial because the buying cycles are long and involve multiple decision-makers. Good data helps you focus your limited resources on the groups with the highest potential. When you tailor your approach, you naturally improve marketing efficiency, spark better product ideas, and create happier customers. That's why so many see segmentation as a core tool for revenue growth. For more on this, check out some effective segmentation strategies on survicate.com.

Defining and Testing Your Segments

With your data analyzed, you can finally start carving out distinct customer segments. The trick here is to start small and stay focused. Don't try to boil the ocean and segment your entire market at once. Instead, pick one or two high-value groups to target first. For example, you might create a segment for "Mid-Sized SaaS Companies in North America Using HubSpot."

Critical Tip: A segment is only useful if it’s actionable. Each group should be distinct enough to deserve its own unique marketing message or sales approach. If you’d talk to two segments in the exact same way, they aren’t really separate segments.

Once you have a potential segment defined, you need to bring it to life with a detailed profile. This often means creating a buyer persona, which is essentially a semi-fictional character representing your ideal customer within that group. Getting specific about their daily frustrations, career goals, and how they make purchasing decisions is what helps you craft messaging that truly connects. If you want to get this part right, you might find our guide on how to create buyer personas helpful.

Finally, it’s time to test your theories. Launch a small pilot campaign aimed squarely at your newly defined segment. Keep a close eye on everything—engagement rates, conversions, and feedback from the sales team. This testing phase is where the rubber meets the road, allowing you to validate your assumptions and tweak your framework before you roll it out on a larger scale. This iterative process is what keeps your segmentation strategy sharp and effective over time.

Putting Your Segments to Work in Sales and Marketing

A perfectly crafted segment is nothing more than a good idea on a whiteboard until you actually use it. The real magic of B2B market segmentation happens when it starts guiding the day-to-day work of your sales and marketing teams. This is the moment your strategy stops being a document and becomes a machine for driving revenue.

For your marketing crew, segmentation is the key to personalizing everything without losing your mind. Instead of blasting out one-size-fits-all campaigns, you can create sharp, targeted initiatives that speak directly to the unique headaches of each group.

Suddenly, you can:

- Design specific ad campaigns for different industries, using the lingo and visuals they'll actually recognize and connect with.

- Build custom email nurture flows that walk prospects through a journey that makes sense for their business needs and the tech they already use.

- Produce industry-specific content—think case studies and whitepapers—that screams, "We get you."

It's not just a hunch. Fast-growing companies pull in 40% more revenue from personalization than their slower-moving peers. That kind of lift doesn't happen by accident; it comes from acting on well-defined segments.

Arming Your Sales Team with a Laser Sight

Over on the sales side, segmentation turns a messy, overwhelming lead queue into a clear, prioritized battle plan. It helps reps focus their energy on the deals most likely to close and gives them the intel they need to have a real conversation from the first "hello."

With clear segments in hand, your sales team can immediately:

- Prioritize high-value leads by focusing on companies that perfectly match your Ideal Customer Profile (ICP).

- Tailor outreach messages that reference a prospect’s industry, company size, or even the software they’re currently using.

- Launch powerful Account-Based Marketing (ABM) campaigns, treating a top-tier segment like a market of one.

This approach makes sure every ounce of sales effort is spent where it counts the most. Once your team knows which leads are the real deal, they can use more advanced methods to guide them through the pipeline. If you want to go deeper, you can check out different sales qualification frameworks that help reps sort and chase the best opportunities more effectively.

Ultimately, putting your segments into action means every single touchpoint—from a LinkedIn ad to the final proposal—is smarter, more relevant, and far more likely to succeed. It's how you stop selling a generic product and start offering a specific solution to a problem you deeply understand, for an audience you know inside and out. That's the hallmark of a segmentation strategy that actually works.

Using AI to Future-Proof Your Segmentation

Manual segmentation is a powerful tool, but it's a bit like taking a snapshot in time. You capture the market as it is right now. Artificial intelligence takes that static picture and turns it into a live, dynamic video feed. It constantly sifts through massive datasets to uncover hidden patterns and subtle connections a human team could easily miss, creating segments that evolve as your market does.

This isn’t about letting an algorithm take over your strategy. It’s about making your market segmentation in B2B smarter, faster, and more predictive. AI can simultaneously analyze thousands of behavioral, firmographic, and technographic data points to anticipate a customer's next move before they even make it.

Think of it this way: AI processes so much information that it can spot the quiet buying signals that tell you which accounts are primed for an upsell, which are at risk of churning, and which prospects are finally ready to talk. This allows you to stop reacting to customer behavior and start proactively shaping it.

This proactive approach is becoming non-negotiable. B2B buyers now live on digital channels, and the amount of data they generate is staggering. Manual analysis just can't keep pace with a modern buyer who expects every interaction to be relevant and personalized.

Predictive Power in Practice

By bringing AI into the mix, you add a new layer of precision to your segmentation. You're not just grouping customers; you're turning raw data into actionable predictions that directly boost your bottom line. It's the engine that powers more sophisticated and effective revenue strategies.

Here’s a look at how AI is changing the game:

- Hyper-Accurate Lead Scoring: AI models can examine your entire history of closed-won deals to pinpoint the exact combination of attributes that define a perfect customer. New leads are then scored against this ideal profile with incredible accuracy.

- Churn Prediction: Instead of waiting for a cancellation email, AI can monitor product usage, support ticket frequency, and other engagement metrics to flag accounts showing early signs of dissatisfaction. This gives you a chance to intervene before it's too late.

- Ideal Timing for Outreach: Predictive analytics can identify the perfect moment to reach out with an upsell or cross-sell offer by analyzing a customer's recent activity and usage patterns.

This isn't just a future trend; it's happening now. A recent GWI report on B2B marketing found that 34% of B2B buyers in key industries already use AI for process automation, while 46% believe it will have a major positive impact on their field.

Of course, for any of this to work, your AI models need clean, reliable fuel. This is where B2B data enrichment becomes a critical first step, ensuring your algorithms are working with the best information possible.

Frequently Asked Questions

Knowing the theory behind B2B market segmentation is one thing, but actually putting it into practice? That’s where the real questions come up. We've gathered some of the most common hurdles teams face when they start building their own segmentation strategy to help you clear them and move forward.

How Is B2B Segmentation Different From B2C?

The simplest answer? You're targeting a company, not an individual.

With B2B segmentation, your world revolves around the organization. You're using firmographics (like company size and industry) and technographics (the software they use) to group accounts together. The goal is to understand a business with complex problems and a whole committee of decision-makers.

B2C, on the other hand, is all about the individual consumer. It zooms in on personal details like demographics (age, gender), psychographics (lifestyle, values), and a person's unique buying habits. Because the B2B sales process is much longer and driven by logic, not impulse, the focus stays firmly on the account level.

Where Do I Start With Limited Data?

You probably have more data than you think. The best place to start is with the customers you've already won.

Your CRM and your sales team's firsthand knowledge are your initial goldmine. Pinpoint your absolute best clients—the ones with high lifetime value, who are a pleasure to work with, and who get incredible results from your product.

Once you have that list, start connecting the dots. Are they all in the same industry? Are they a similar size? Did they all come to you with the same problem? These initial insights are pure gold and will help you sketch out your first customer profile without any fancy or expensive tools.

Key Takeaway: Your happiest customers are the blueprint for your ideal segment. Figure out what makes them a perfect fit, and then go find more companies just like them. It’s the simplest and most effective way to kick off your segmentation work.

How Often Should We Update B2B Segments?

Your B2B segments shouldn't be carved in stone. Think of them as living documents that need to evolve. Markets shift, competitors make moves, and your own product changes, so your segments have to keep up. A formal review once or twice a year is a solid baseline.

That said, certain red flags should trigger an immediate look. If you see a key segment’s performance suddenly dip—maybe conversion rates drop or deals slow down—it’s a clear sign their needs have changed or something is off. Staying nimble is what keeps segmentation working for you in the long run.

Ready to stop guessing and start targeting with precision? The Nordic Lead Database gives you the accurate firmographic and technographic data you need to build powerful B2B segments. Find your ideal customers today.